Simulating Various Asset Allocation Strategies

Project Overview

Monte Carlo and Historical simulations of various asset allocation strategies in retirement funds. This module models:

- Growth of contributions over time (Roth/Traditional)

- Performance of various asset allocation strategies and glide paths using both monte carlo simulations and historical data

- Impact of Federal and NYS tax

- Withdrawals, SSI, RMDs, and more

Examples and Results

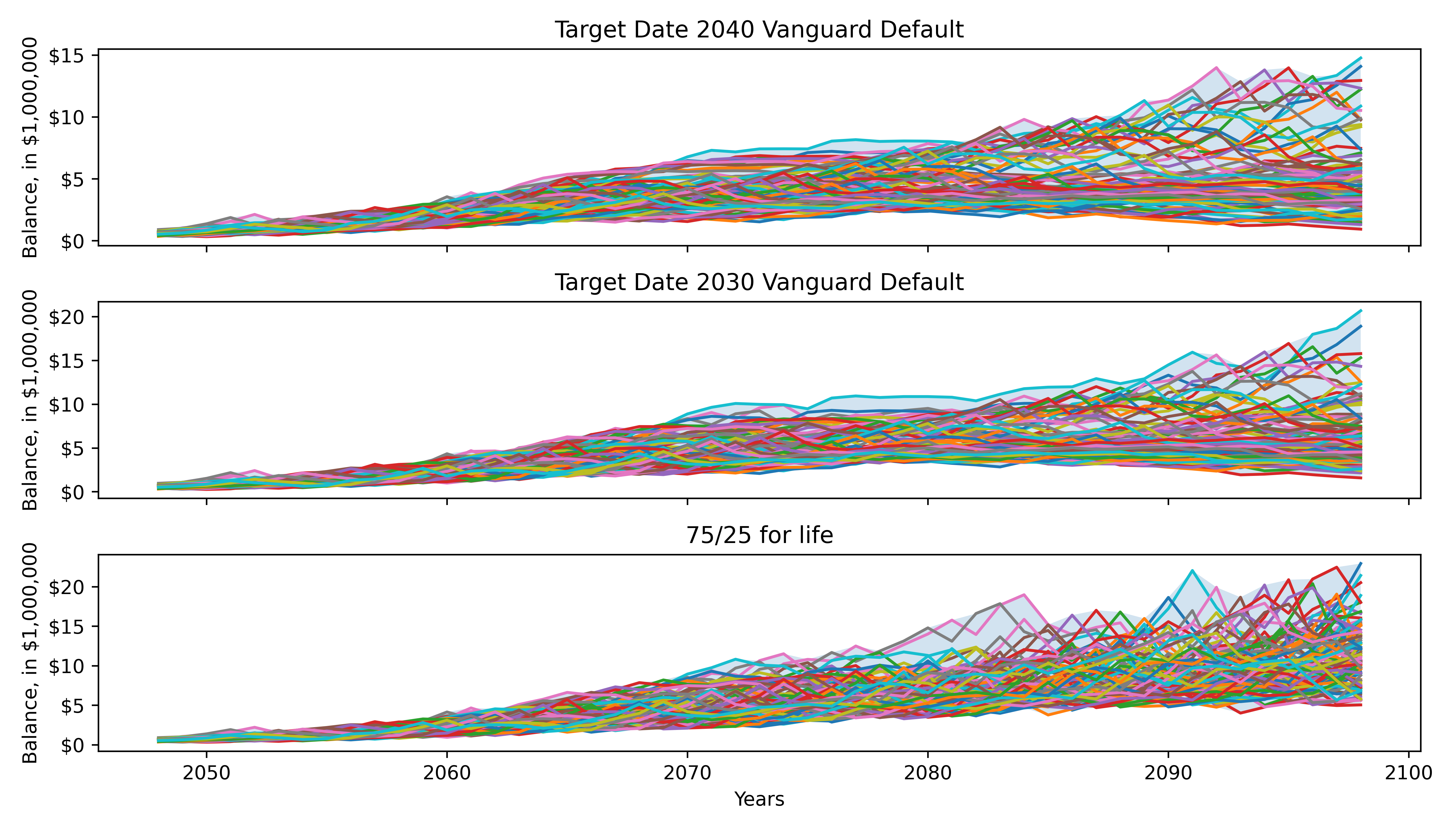

| Time Series Plot (Historical Simulations) |

|---|

|

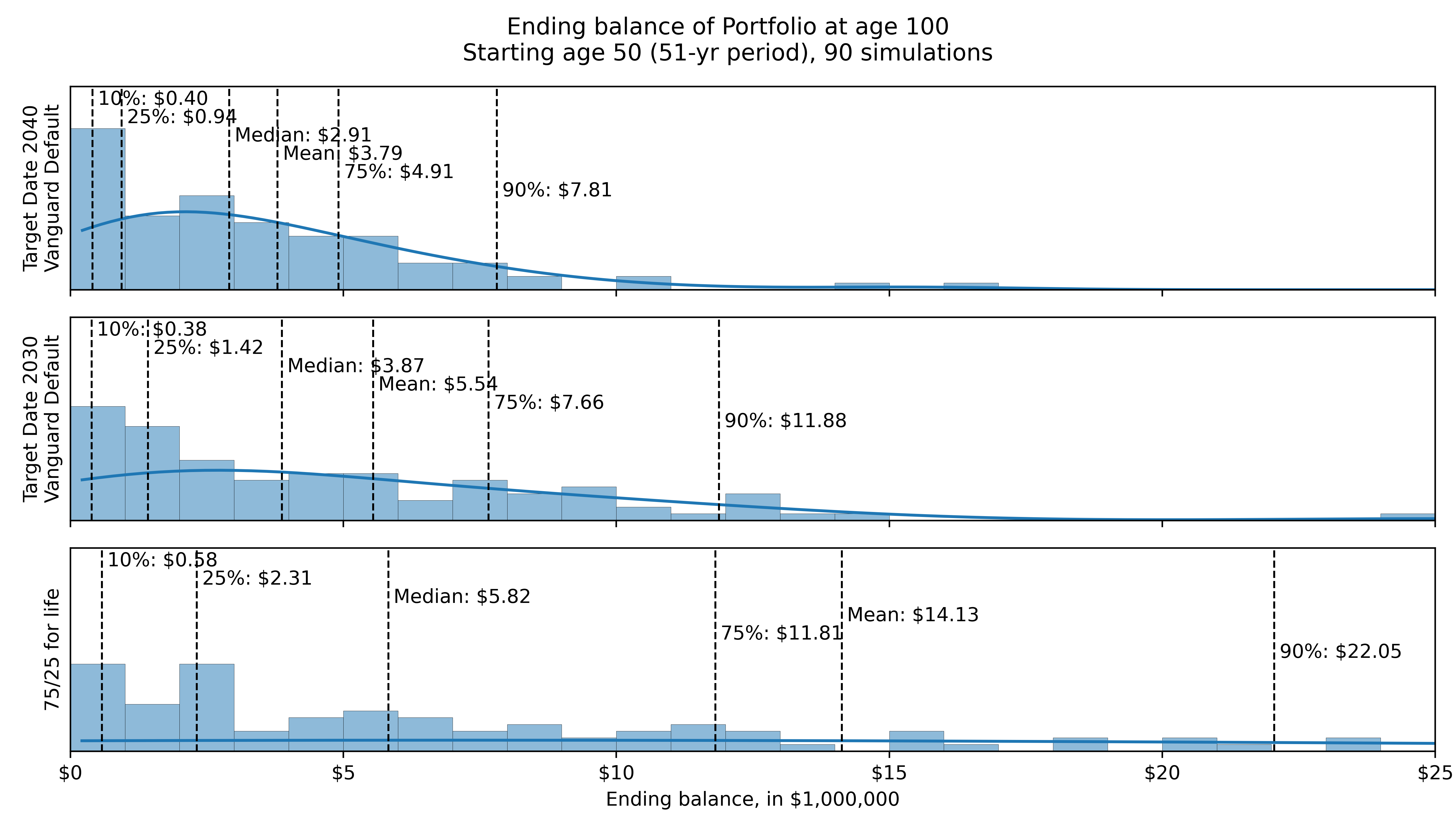

| Histogram of Ending Balance (Monte Carlo Simulations) |

|---|

|

More details and examples can be found on my github, below.