Automated Trading System

Project Overview

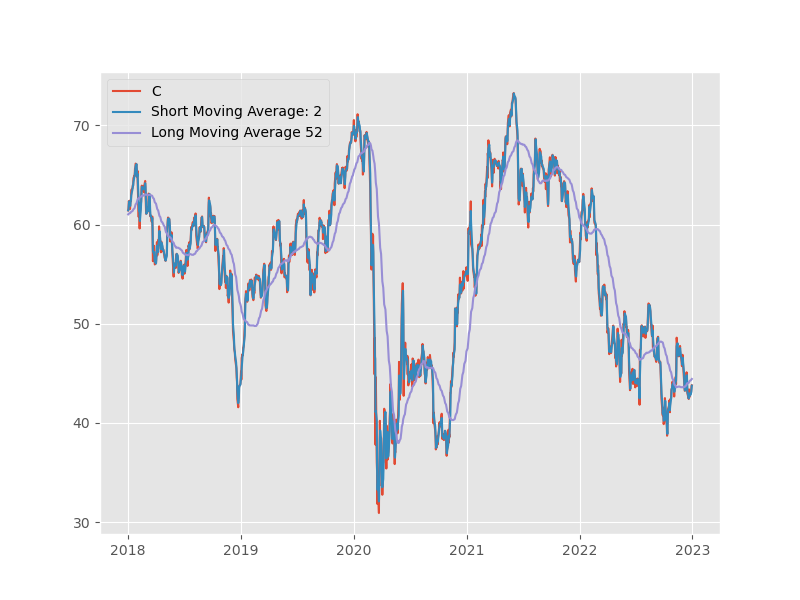

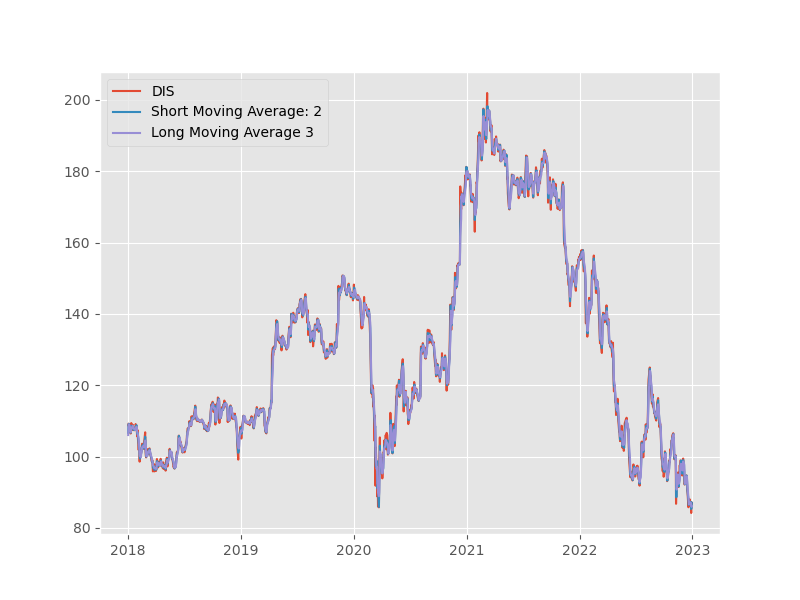

This Automated Trading Analysis, developed as part of my academic journey in CUS690 - Applied Analytics, showcases my hands-on approach to stock trading strategy optimization using historical data. The project leverages the pandas_datareader API, and contains a StockTrader class for trading individual stock data and PortfolioTrader for managing multiple stocks within a portfolio. The progtam explores the fine-tuning of short_moving_average and long_moving_average values for a specified stock portfolio. This project allowed me to gain insights into basic trading strategy principles while practicing my data analysis and python development skills.

Strategy and Implementation

At its core, the PortfolioTrader class conducts a grid search for each stock’s optimal short_moving_average and long_moving_average parameters within user-defined ranges, aiming to maximize returns over a trading period.

The trading strategy can be summarized as:

- Sell:

short_moving_averagecrosses belowlong_moving_average - Buy:

short_moving_averagecrosses abovelong_moving_average(after a sell) - Buy More:

short_moving_averageconsistently stays abovelong_moving_average

The project’s focus is on maximizing returns by optimizing parameter values. Performance assessment includes logarithmic and arithmetic returns.

Trading Results and Analysis

| Citigroup Stock Example | Disney Stock Example |

|---|---|

|

|

More details and examples can be found on my github, below.